By Piotr Pietrzyk, Managing Editor, 6GWorld

NVIDIA’s 2025 COMPUTEX keynote wasn’t about GPUs. It was about power. Not just watts, but platform power—redefining who builds networks, who owns infrastructure, and who gets paid when a packet flies. Jensen Huang’s real message? The data center is now the chipset. The RAN is a CUDA kernel. And if your 6G strategy doesn’t include this shift, you’re not late—you’re irrelevant.

What Actually Happened: A Recap in Six Bold Moves

| Pillar | What Huang Dropped | Why It Matters to 6G |

|---|---|---|

| AI Factories | GB300 “rack as motherboard” with 130 TB/s MVLink spine and 1.5× inference boost | RAN and core functions can now co-reside in GPU farms—6G’s control plane just got liquid-cooled. |

| MVLink Fusion | Open chiplet + switch IP for 3rd-party ASICs/CPUs to dock into Blackwell fabric | Lets telcos plug custom PHY or beamformers into AI-native compute domains. |

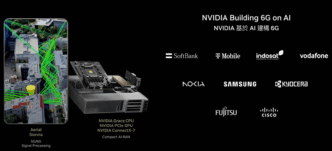

| Aerial Stack | GPU-accelerated 5G/6G radio processing—claims parity with ASICs on energy/bit | Radio functions become updatable software libraries, not hardware refreshes. |

| RTX Pro Servers | Blackwell RTX Pro + CX8 networking = deterministic edge cloud + AI agents | Slices and services co-exist in one AI-native platform. |

| Digital Twins & Newton | GPU-trained humanoids, synthetic data generation, and Omniverse-powered robot factories | 6G AI/ML model training and policy testing can loop within the same simulation system. |

My Unapologetically Subjective Take

Huang didn’t pitch GPUs—he pitched a new socioeconomic substrate. One where compute, connectivity, and cognition are no longer separate verticals, but modular extensions of the same factory. His “AI factory” metaphor wasn’t just branding—it’s the new industrial logic of 6G: turn electrons into tokens, and tokens into margin.

With racks now moving more traffic than the global internet and generating metered “intelligence output,” the calculus of spectrum ROI changes. The value isn’t in radio resource management anymore—it’s in token throughput per watt, per rack, per second.

Aerial’s quiet revolution? After six years of tuning, the GPU now matches ASICs on data-rate per watt—and trials with Vodafone, SoftBank, and T-Mobile prove it’s no paper launch. The ASIC vs COTS debate is over. The GPU won without firing a shot.

⚠️ Threats and Opportunities by Stakeholder

| Stakeholder | Opportunity | Existential Threat |

|---|---|---|

| Mobile Operators | Flash new waveforms like driver updates; co-sell AI tokens as a service | If they don’t own (or lease) AI factories, they become dumb pipes to hyperscaler-owned cognition. |

| Hyperscalers / Cloud | MVLink Fusion lets them eat the RAN stack too—full GPU-native RAN+core+AI stacks | If they go too vertical, regulators may classify them as unlicensed telcos and clamp down. |

| NEPs (Network Vendors) | Pivot to selling modular GPU-centric O-RAN boxes using NVIDIA libraries | ASIC-based DU/BBU portfolios become technical debt. |

| Semiconductor/IP Vendors | New revenue: chiplets, beamformers, QPUs docked into open fabrics | Closed PHYs and fixed-function DSPs get abstracted away as just “another IP block.” |

| Regulators & Govs | Domestic AI fabs = sovereign 6G infrastructure. Easier to inspect CUDA than opaque ASICs | Concentrated power means single points of failure—and new geopolitical targets. |

For those tracking how AI-native infrastructure will reshape telecom, our upcoming summit at 6GSummits.com/secure-ai dives deep into securing and scaling AI-driven RANs and spectrum systems.

🥇 Winners, Losers & Wildcards

🏆 Winners

- Power-rich, spectrum-poor countries (Nordics, Gulf states) who can host Stargate-class AI factories

- RAN start-ups with software DNA—now shipping “app store” functions over Aerial

- Fiber/cable providers—every AI rack eats terabits

📉 Losers

- Mid-tier NEPs without strong silicon or AI IP

- Appliance vendors still betting on x86 or Windows—Huang made clear that AI-native compute doesn’t need either

- Operators invested in private 5G ASIC-based stacks—the depreciation just evaporated

🎲 Wildcards

- Quantum accelerators: CUDA-Q invites them in, but NVIDIA may absorb the value chain

- Open-source: NVIDIA’s flirtation (Newton, NIM-IQ) is real, but CUDA still rules the roost

Five Questions the 6G Industry Can’t Ignore

- Is a GPU-first RAN energy-viable at macro scale? Or are we just trading diesel gensets for liquid-cooled lagoons?

- If tokens/sec becomes the KPI, do telcos lose billing rights to cloud meters?

- Can regulators audit a Frankenstein fabric made of proprietary chiplets + CUDA + open-source physics?

- Is 130 TB/s in-rack bandwidth the death knell for copper? Or does photonics finally arrive?

- When a bad AI param bricks a sector, who takes the fall? The NEP? The cloud? The open-source repo?

What to Watch (Like a Hawk)

- Field KPIs: SoftBank & Vodafone’s Aerial power-per-bit numbers will define the future of telco ASICs

- MVLink Fusion wins: If Qualcomm/MediaTek ship working chiplets, we’ve entered the multi-fabric era

- 3GPP turbulence: Release-19/20 may shift focus from protocol tweaks to compute fabric standardization

- AI factory siting politics: Expect government lobbying wars for Stargate-class deployments

- Open-source playbooks: If CUDA headers become the new RFCs, standards bodies will struggle to keep up

Final Words

When the radio stack becomes a library call, spectrum stops being the moat.

The next battle isn’t fought with Gs—it’s fought with tokens, models, and compiler optimizations.

6G is no longer being fabricated. It’s being compiled.

Buckle up.